Usda loan how much can i borrow

The second is a monthly mortgage insurance premium thats 04 of the loan balance. The current 30 year mortgage fixed rate as of August 2019 is 358can you cancel pmi on fha loan Know these 3 loan types before you go mortgage.

What Is A Usda Loan And What Should You Know

The current USDA mortgage insurance rates are.

. Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Ad We Offer Competitive RatesFees Online Tools - Start Today. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

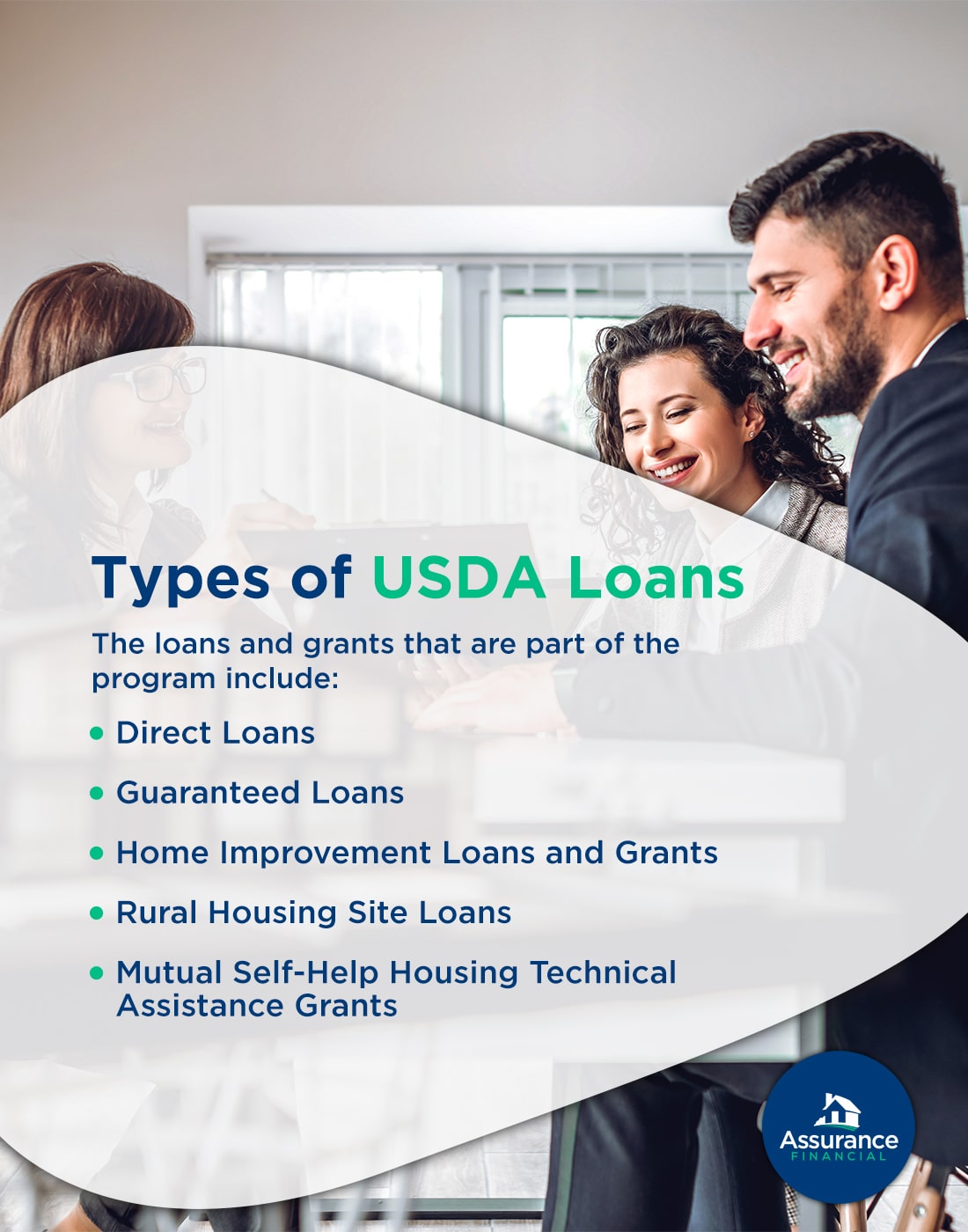

To qualify for the USDA loan program you must. For instance if your loan is 300000 the upfront guarantee fee will be 3000. This loan can help with paying closing costs constructing or improving buildings on the.

The first is a payment equal to 2 of the loan amount which is due at closing. It can go higher if there are compensating factors like a great credit score or extra savings. For many FHA borrowers the minimum.

Effective August 1 2022 the current interest rate for Single Family Housing Direct home loans is 325 for low-income and very low-income borrowers. For a USDA Rural Home Loanit. As for your annual guarantee fee if your principal balance is reduced to 280000 it will be 980 8167 per.

Farm Ownership Loans can be used to purchase or expand a farm or ranch. What are USDAs income limits. Therefore lenders and loan.

But if you need to borrow against your home equity note that USDA loans do not provide a cash-out option for refinances. Calculate Your Mortgage Payments With Our Calculator And Learn How Much You Can Afford. Fixed interest rate based on current.

How much can I borrow. Calculate your payment now using our USDA rural home mortgage calculator. Effective August 1 2022 the current interest rate for Single Family Housing Direct home loans is 325 for low-income and very low-income borrowers.

See a breakdown of your costs including taxes and the USDA guarantee fee. Credit score Mid will be about 650. USDA Nationwide funds up to 100 new double and triple-wide manufactured modular and site-built homes in.

The answer for home buyers is It Depends. Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Apply for a loan.

Purchase a home thats intended to be your primary residence. That means you can qualify for a USDA loan with an annual. There are a lot of things that can qualify as a compensating factor for the USDA Rural.

I am often asked Paul how much can I borrow with a USDA Rural Home Loan here in Arizona. Use our USDA loan calculator to see how much mortgage insurance will cost for your loan. Geographic Must purchase a home in a USDA-eligible rural area most areas outside major cities are eligible Income limits Household income must be at or below 115 of the areas.

Fixed interest rate based on current. Use our free USDA loan calculator to find out your monthly USDA mortgage payment. All USDA loans require a 100 upfront cost the guarantee fee as well as 040 of the loan.

100 upfront guarantee fee based on the loan amount. Fixed interest rate based on current. Ok I think Im in the general range but not sure.

Bank Services Many Of Our USDA Loans Has A Variety Of Financial ProductsServices. However there are some areas. Department of Agriculture USDA supports homeownership opportunities for low- and moderate-income Americans through several loan grant and loan guarantee.

Monthly income is 312706 Gross Car payment 38250 student loan 4900 No other debt. 100 upfront guarantee fee based. Most areas in the country have a 91800 household income limit for a dwelling with one to four people.

In addition to eligibility todays mortgage programs use debt-to-income ratios to determine how much mortgage an applicant is eligible for. Citizen or have permanent residency. Additionally the USDA home loan program uses a borrower debt-to-income ratio of approximately 41 to determine what size loan you qualify for as compared to a debt-to-income ratio of 43.

2 days agoThe US. Effective August 1 2022 the current interest rate for Single Family Housing Direct home loans is 325 for low-income and very low-income borrowers.

Usda Rural Development Direct Housing Loans Kentucky Usda Mortgage Lender For Rural Housing Loans

Conventional Loan Vs Usda Loan Comparing Loan Programs

Rural Development Home Loan Advantage Rcb Bank

What Is A Usda Loan And How Do I Apply

Usda Mortgage Loan Lenders In Pa Md Requirements Rates

Usda Maryland Home Loans

Fha Vs Usda Loans What S The Difference Assurance Financial

What Is A Usda Loan And How Do I Apply

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Kentucky Usda Rural Housing Loans Information Video

What Is A Usda Loan And How Do I Apply

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Tumblr Home Loans Usda Loan Usda

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Kentucky Usda Rural Housing Loans Information Video

What Is A Usda Loan Eligibility Rates Advantages For 2020 Usda Loan Home Buying Checklist Fha Loans

![]()

Usda Rural Housing Mortgage Requirements And Guidelines

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow